Nothing I am about to describe in this article is completely new. It may simply be something you did not realize was so viable, realistic and within reach in a market like Toronto. Disclaimer: Consult with the city, planners, lawyers and contractors prior to jumping into this.

Tying it together:

My last article was built off the premise of buying a cash flowing real estate investment instead of buying your own home in downtown Toronto. The numbers showed that buying a condo in downtown Toronto resulted in a ~ 4% ROI.

In this article, I broke down a cash flowing investment strategy for the Toronto real estate market. The focus is on how it can allow you to live for free in Toronto.

Now, if you want to learn the secrets to free living — keep reading :)

House Hacking:

House hacking is a well-known concept in the Real Estate Investing community and more specifically the FIRE (Financial Independence Retire Early) community. It is a way to reduce your monthly fixed costs, which should enable you to save a larger chunk of your earnings to redeploy into additional investments — which, in turn, increases your overall income while reducing your fixed costs. The best part of house hacking is it teaches you a lot about the fundamentals of real estate investing and being a landlord.

I wrote a brief article on how to make money on buying in "The Real Estate Wedge", if you are interested in learning more about this - check out the article here.

If you are interested in house hacking, step 1 is to purchase your property. Alternatively, you can also do this with a master lease, if you do not have the funds to purchase a home right now. Let’s assume you are looking to purchase a house and want to reduce the cost of your ownership.

This works with anywhere from 5–20% down (FYI — less than 20% only works if you will be occupying the home). Your down payment simply impacts the amount of money leaving your pocket on a monthly basis.

Let us assume you put 20% down with a 30 year amortization (see sensitivity analysis at the bottom on your returns if you went 5% down and a 25 year amortization). This time I outlined two ROI’s, one with price appreciation and one without.

The House Hunt: Bungalow house, 2 or 3 bedrooms with the opportunity to increase the number of bedrooms

You should look for an opportunity to increase the rent in a house beyond what the seller perceives the rent to be.

How? An easy way to do this is to look for the opportunity to increase the number of bedrooms in a home. For example, a lot of bungalows in Toronto (specifically Scarborough) currently have a dining room. When was the last time you sat and ate dinner in your dining room? In the modern era, there is no need for a full dining room in rental properties. Buying a 3-bedroom bungalow with a dining room, is the same as buying a 4-bedroom bungalow if you can see the opportunity (buy the home and convert that dining room into a bedroom). The result is you can buy a house, add an additional bedroom and collect higher rents from your tenant.

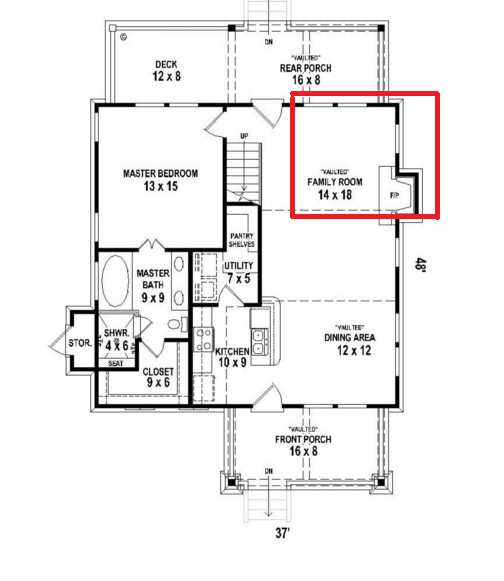

Here is an example of a 1 Bedroom Bungalow. The Family room is PERFECT to be sectioned off into a 2nd bedroom. You will still have plenty of space to have a small table and family room after doing this.

Example Scenario:

Assume you purchased a 3-bedroom home in Scarborough to move into. Based on what was on the market in December 2019, a 3-bedroom bungalow house would go for around $775K plus closing costs of 20K resulting in about a $800K house. Daunting, right? That is exactly why you need to house hack.

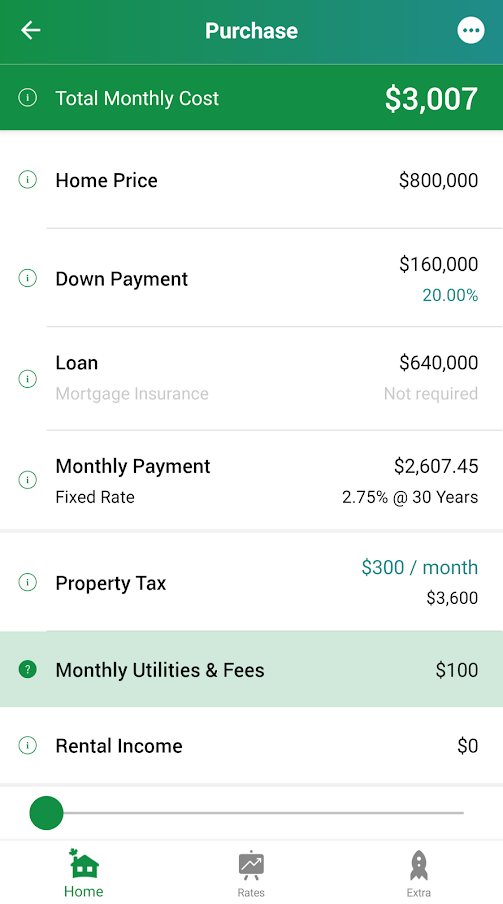

The mortgage payment would be $2,612 per month using a 30-year amortization and 20% down payment. Including property taxes and insurance this will end up around $3,000 a month.

Check out the Canadian Mortgage App: (Amazing tool to use when analyzing RE Properties!)

Total cash outflow from your house on a monthly basis: $3,000 per month.

Let’s start with the easiest form of house hacking. Renting out the basement.

Many of us know family members that have rented out their basements growing up. My father did this as soon as my sister and I moved out for university. I know giving up your basement may not be ideal for everyone, however for house hacking to work you do have to sacrifice a little bit. Short term sacrifice for long term gain.

You likely never realized how big of a gold mine that rarely used basement really was. This is especially true in the extremely high rent markets like the GTA today.

The basements in bungalow houses built in the early to mid 1900’s is huge. In deciding how to optimize your collectable rent, you should consider things like wear and tear (more tenants = more wear and tear), tenant quality (type of people that rent a 1 vs 3 bedroom) and legality (what the city will and will not let you do). I have outlined a few options that will work in some bungalows.

You can add:

- One unit with 3 Bedrooms — with limited living space. Rent $1,800

- One unit with 3 bedrooms and decent family room space. Rent $2,000

- One unit with 2 bedrooms and limited living space. Rent $1,400. An additional one-bedroom unit. Rent $1,000. Total Rent $2,400

- One unit with 2 bedrooms and decent family space. Rent $1500. An additional studio unit. Rent $800. Total Rent $2,300

- Three units with 1 bedroom each. Rent $1000 each. Total Rent $3,000

Potential layouts for 2–2 bedroom, if you make one of the bedrooms into a kitchen / living room.

Some bungalows have sufficient basement space to fit even more than this — I’ve seen a 4-bedroom unit + a 1 bedroom, two 2-bedroom units, and much more — but for simplicity let’s leave it at this. So, be creative with your space and ensure there is no wasted space. For simplicity, let’s discuss our 3rd scenario above.

Scenario 3 brings in a total rent of $2,400. You are also reducing your tenant risk over multiple tenants and avoiding large groups at the same time. If you want to reduce your capital outlay, go for option 2 and have one family or group in your basement. While option 1 provides maximum rent, your tenant quality will be questionable.

Now you are bringing in $2,400 from the basement alone. If you are the type that does not want to have roommates, this means if you live on the main floor of your house, your cost is now $600 a month. A lot of Torontonians would love this cheap cost of living — but there is MORE potential to discuss.

Total rental income from the basement alone: $2,400 per month.

With only renting out the basement, your monthly cost of living is $600.

How to Get Paid — The Main Floor $ $ $

Remember how I said you would have to sacrifice a little bit?

This is where the real sacrifice comes in to play and is dependent on how much you value financial independence. How badly do you want to be financially free? How much are you willing to cope with? Are you okay having roommates?…

If you are not okay with it, you have a $600 monthly cost of living which is not bad at all. But for those of you that are super frugal/ super FIRE, your main floor is how you will get paid.

The Conversion:

Its time to make that 3-bedroom home into a four bedroom. The dining room that was beautifully sectioned off and likely has its own window, can be made into a separate bedroom. There is a legal definition for what makes a bedroom, so I suggest you look that up. From my understanding — if it has a window and a closet for the most part you should be fine. Once you do this (a little bit of drywall, some paint, doors, etc.), you now have a 4-bedroom house. At this point you’ve given the value of your house a solid lift because 4 bedroom house price > 3 Bedroom house price (more on this to come in a later article).

Each bedroom can be rented for at least $700–800 a room in Toronto. Assume $700 a room, across 3 bedrooms (because you still need 1 bedroom for yourself), means $2100 per month in rental income.

Main Floor Rental Income: $2,100 per month.

With 3/4 main floor bedrooms rented out and your basement rented out, your total monthly rental income is $4,500.

Total Monthly Cash Inflow (Rental Income): $4,500.

Total Monthly Cash Outflow: $3,000 per month.

Get paid $1,500 per month while living in your house for free. :)

But remember, now you are being extremely frugal and have created your own cash cow. Save that money, reinvest it and grow your wealth.

Sensitivity Analysis/ROI:

If you want to do a proper investment calculation make sure you consider Vacancy costs, Repairs and Maintenance and Capex. Since the preface for this is house hacking and not purely an investment I excluded these costs (also since it should be offset by the 4th bedroom if it is an investment).

Note: I make no comment on the permitting, licensing and approving process in the city of Toronto. Often these bungalows can be found with units previously in them at which point you are just doing a quick update. These will all play a factor in your renovation costs.

Looking to create your love story? Join the other couples who have dated and married through myTamilDate.com!

"How a Message on myTamilDate.com Led to an Engagement for Lavanya & Vitharan"