We are in an economic state, of high debt, high unemployment and we the consumers should really be taking our finances and budgeting seriously. I try my best to simplify what is going on in our economy today and what we can potentially experience going forward. The main message, is documented on the last page, it is simply to sit down with those that you love, and really just have a plan, a budget. This will at-least allow you to have a map to navigate going forward. I initially wrote this for my family, but there are too many hardworking families in our country that need to hear this.

The purpose of this memo is to provide a very high-level depiction of what I think will transpire as a result of this pandemic. I choose to write this piece, primarily so I can provide some “food for thought” with those that I love the most, family.

I refrain from going into the details of numbers in this memo, and rather maintain to keep it simple and easy to understand. I welcome you to have a read, stir your own thoughts and critique, but my main objective is to get you thinking and planning.

So, let’s begin.

The global impact of COVID-19 has left an unprecedented death toll. For many, being stuck at home and occasionally making trips to the grocery store has been the continual cycle since the implementation of social distancing. As we begin re-opening to a life post-COVID-19, you can only begin to imagine the many interactions that will now be different as a result of fear that may be instilled in you.

Here I sit in my desk trying to make a connection on how this post-pandemic life will impact the state of the economy, more importantly impact an individual consumer in the economy. These factors include high consumer debt, high unemployment, and the growing volume of printed money feeding the stimulus needed for families and businesses alike. Given the state of where our economy is going, I worry about the financial vulnerability hardworking families face in the immediate years to come. Below I will try to tackle a few different topics in a simplistic manner that have a great relation to the occurrence of this pandemic.

Government Stimulus. As a result of COVID-19, the Canadian government committed to over $149 billion dollars in relief funds. While the average citizen who is severely impacted by this pandemic receives a slight moment of relief, ultimately the distribution of these stimulus packages will have a greater impact on the economy that the average person will not understand. To have a more thorough understanding, we will highlight the 2 primary bodies of the government and their role in this pandemic.

1. Federal government

Generally speaking, the federal government has many roles, primarily dealing with international and national issues. The primary source of revenue earned by the federal government is through the taxation of individuals and corporations. These funds allow the federal government to take on various projects nationally and also able them to distribute funds provincially and municipally for more local matters.

2. Bank of Canada

The Bank of Canada is a special type of Crown Corporation, which falls under the federal government. The primary responsibility of the central bank is to formulate and sustain the Canadian monetary system. The Bank of Canada has the capability to print money and distribute the funds into the financial system. Although the Bank of Canada falls under “ownership” of the federal government, it carries out its responsibilities separately and independently. Why? This is mainly because they do not want to get the partisanship of government mixed in with the responsibility of providing a sound and objective financial system. In plain English, you don’t want the person running your country also having the power to decide how much money to print and distribute and what interest rate to set. In such circumstances, you would introduce too much subjectivity into the matter and would threaten the stability of the monetary authority.

A Canadian taxpayer may wonder, “are we paying for the fiscal stimulus and various other COVID-19 benefits?” The answer is no - for now. The Bank of Canada has printed money, effectively increasing the total supply of money available in the economy. Subsequently, the Bank of Canada is engaging in a transaction, and exchanging that money to the federal government and in return receive a form a bond. The definition of a bond can get quite complex as bonds vary in different maturity dates and yield (return rates). For simplicity, a bond is a sum of money the investor (Bank of Canada) is giving to the Federal government in return for fixed interest payments and the principal amount at a later date. Once this transaction occurs, the federal government has $XXX of funds available to now plan accordingly and distribute the funds to each provincial jurisdiction for various stimulus needs.

You might wonder - well if the government didn’t have its own funds in the first place to distribute, how will they manage to pay the interests and principal amount back? The forms of repayment can vary and can get quite complex, but effectively the funds used to pay this balance back, is the future taxation earned on individuals and businesses. So really, we the taxpayers are deferring the payments for a future date. Unfortunately, there is no such thing as free money.

The stimulus has granted some people relief because a form of life support has been provided. Although, some are irritated because the relief is simply not enough. What the majority of consumers fail to understand is the lava is brewing underneath all this, and this is amplified because of the global pandemic. That lava is rising debt.

Short-term deflation: It would be reasonable that the upcoming months will primarily consist of a deflationary period. A deflation in this state of the economy is due to the majority of businesses now resuming operations, at a smaller scale, post a 2-month closure. We can expect the price points for many services and products to fall. Industries such as retail stores will have the biggest impact from a deflationary period because an average consumer won’t be willing to go spend their disposable income on items such as clothes. Rather, consumers will most likely look to save their cash, only purchase essential items, and in most cases will need those funds to pay off their interest on outstanding debt.

In understanding the potential consumer behavior changes, from a retail business perspective, the commonsensical response is to drop selling prices, sacrificing your margins, and hope consumers will continue shopping because of discount prices offered. Why is this important? Your ability to pay off your business expenses (i.e. rent, loan deferrals) is heavily reliant upon consumer spending. At a time like this many businesses’ have already been over-leveraged (high use of debt), and therefore sufficient streams of revenue to stay afloat remains vital. During a period of deflation, the Bank of Canada is unlikely to raise interest rates, as doing so would cause tremendous difficulty for consumers to pay off credit and will disincentivize consumer spending. Furthermore, it would make credit re-payments for businesses more expensive.

Long term Inflation A short-term deflation will lead to a long-term inflation problem. How? This is primarily caused by the gradual activity of money printing or in finance known as “quantitative easing” done by the Bank of Canada. The printing of money and the idea of stimulus may seem to be a huge relief for society but can have long term negative effects. In response to the financial crisis in 2009, the Canadian government printed over $60 billion dollars to fight the economic problem. Similarly, from 2009 – 2011, the economy faced an immediate deflationary period followed by significant inflation.

In an economic scenario, when you have too much supply of money, the value of the Canadian currency, over time, devalues and ultimately leads to inflation (price of goods and services increasing). This is because the current monetary supply is focused towards consumer spending (i.e. food) and not for real productivity, which assists in stimulating the economy. So, $1- what used to be worth $1 - is now worth $0.60. How does that impact us?

I want you to picture yourself with only $100 in your pocket. That $100, prior to COVID-19 may have bought you 10 things at the grocery store. Down the road, as a result of inflation, $100, may only allow you to buy 5 things, given the devaluation in the currency. Your cost of living increases and your cost to service (pay off) your credit card debt and mortgages becomes harder and more expensive.

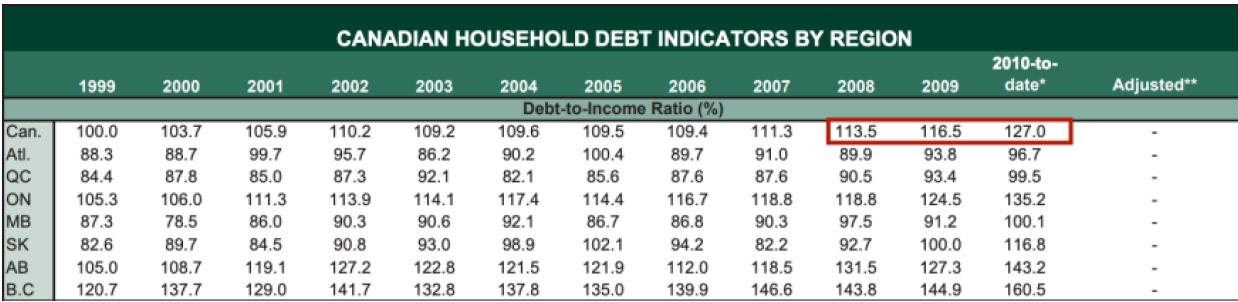

Below, I have obtained the debt to income ratio from the previous financial crisis that has continued to grow as of today.

Source: TD Economics [1]

The debt to income ratio highlights the amount of money you owe in proportion to what you earn. Canada in 2009, had a ratio of 116.5%. This means that for the average Canadian, for every $1 earned through income they owed $1.17 dollars. The debt to income ratio as of the end of 2019 is now 176%. According to BNN Bloomberg this number could rise well over 200% by 2021 given the impact of COVID-19.

Today, the total consumer debt in the country, which includes your credit card, loans and lines of credit totals a staggering number of $1.989 trillion, while mortgage debt is now 1.34 trillion[2].

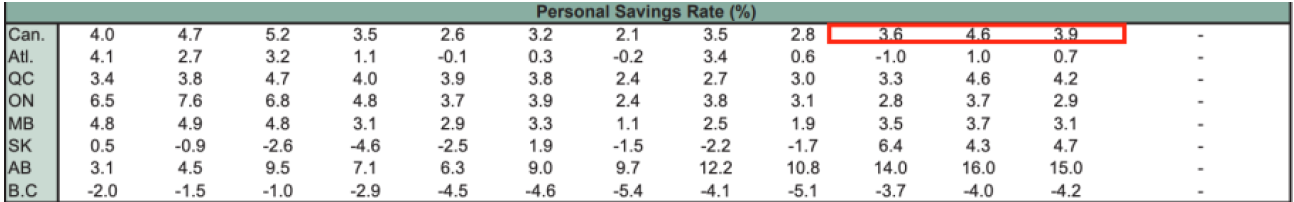

To make things a bit more surreal, the personal saving rate from 2008 – 2010 was below 5%. The number remains at roughly 3% as of 2020. That means for every 100 dollars you earn, you only put away $3. In places like British Columbia, you’re actually in negative territory and are not saving at all but rather resorting to using additional credit.

Source: TD economics[3]

Simply put, the average citizen in this country, is living based off the prosperity of having access to relatively cheap credit and over time has created a massive financial deficit. Any debt outstanding becomes harder to pay, for both the consumer and the government. So, if you as a citizen are unable to pay your personal debt and mortgages it has a trickle effect upwards and can become a complete disaster.

Unemployment: This is what I consider the devils eye in this whole situation. High unemployment drives the vehicle into complete disaster. Unemployment as of April 2020 reached 13%, levels we haven’t seen since the great depression in the 1930’s. This is an important factor that I’d like you to understand because ultimately this may drive us to a much worse collapse then what was experienced at the end of March.

Imagine being unemployed, however, to keep things a bit more realistic let’s add a few factors. First, perhaps you have bought a home during the last few years and as a result have monthly mortgage payments to make. You also have a credit card, used for day to day activities with a sufficient amount outstanding. Maybe you are a new family, with young kids, which means child costs (food, daycare, clothes and diapers). Your occupation, well you may have your own business - perhaps a home builder - and job demand really depends on the market of construction. As a result of COVID-19, the demand for home building is low due to the fact people lack discretionary income and as a result you have been unable to go out and work. Simultaneously, all of your home bills, credit card and mortgage bills have been deferred for 6 months until late summer.

Fast forward, to September, and understand how many deferred bills are now due from the previous 6 months. The uncontrollable force here, is whether you have a job, and even if you have a job, are you able to earn enough to cover 3-6 months of deferred bills while still being able to put food on the table? These are serious conversations and planning all family members should’ve been having the moment this pandemic took flight.

If you were to ask me, I personally do not believe unemployment will be decreasing, and if anything, I think it is more likely to increase. The virus has now changed human behavior and interaction forever in one shape or form. It is difficult to imagine businesses back at full capacity for a year, at minimum. Like the experts say, nothing really can be confirmed until a vaccine has been discovered. In the best case, you have half of the unemployed public back at work, yet even then, there will still be 50% of people that are negatively impacted. Unfortunately, from a business perspective, a retail store that may have had 100 employees prior to COVID-19 won’t be able to hire the same number of employees back. As mentioned above, this is due to extraneous factors that have shifted their primary focus to cover expenses and survive. By adding more employees, they are increasing their payroll expenses and future obligations.

What can I do: The most important step an individual can make right now is to financial plan/budget with their family. There is no form of complexity and follows a simple method:

1. Identify all of your cash inflows

a. i.e. Employment income, rental income, any liquid cash inflows

2. Identify all of your expenses

a. i.e. Rent, mortgage, bills, Food, Entertainment, Insurance (car)

3. Cut all unneeded expenses

a. This will primarily be our entertainment expenses (i.e. Spotify)

b. Keep one form of entertainment & Communication. Cut the rest (i.e. Keep Netflix and individual cellphone plans, cancel TV cable and home phone cable)

c. Cut outside meal expenditures accordingly

Again, what I’ve noted above is just an example, and will undoubtedly vary on a consumer to consumer basis. The most important thing you want to accomplish, is to get your cash inflow covering your primary debt (rent, bills & mortgage) and ideally you would like to be contributing further to your savings account. For those that need a budgeting template, I can send over a template.

A second consideration is the idea of downsizing. If you have high expenses due to rent payments, it may be time to move back in with the parents. Of course, this is dependent on the availability. This short-term strategy will allow you to cut a major cost, in rent expense, and allow you to allocate those funds to other outstanding debts and potentially even savings.

For a highly leveraged individual, in most cases an individual who may have one or even multiple mortgages - this presents an extremely thin timeline to deleverage with a serious uncertainty of what the housing market will look like. Do me a favor, go for a walk around your neighborhood, and try to identify how many “For Sale” signs you are able to observe. Now do the same thing in the fall, I think you may see a greater number of signs. I believe the housing market will collapse as a result of low/medium income families whom are highly levered and looking for liquid cash for survival purposes, especially in areas like BC & Ontario. I believe we can see this occurring at the end of 2020, if the high unemployment persists. A more thorough analysis will be provided in a separate memo.

I hope this has sparked some thoughts and more importantly, I hope you all are actively speaking with your loved ones to ensure that there is a financial plan for a worst case scenario. There is always light at the end of the tunnel but as of right now we are uncertain how long this tunnel will be, and we need to withstand any setback until we see that light again.

Sincerely,